🀄️Watch These Trends In September - DeFi Frameworks Newsletter #004

Your biweekly newsletter on the latest performance, news, catalysts and more

Welcome to the fourth edition of the biweekly DeFi Frameworks newsletter. While crypto prices are boring, there is a lot to touch on and many upcoming catalysts to monitor. Today’s newsletter will get you up to speed and cover the following:

Bullets

Market Overview 🗺

News and Catalysts 📰

On-chain Movements 🐳

DeFi Airdrops & Strategies 🔮

Market Overview 🗺

DeFi liquidity is at its lowest level it’s been since February 2021. It’s no secret that a high interest environment makes it less attractive to chase on-chain yields. This combined with declining crypto prices has caused a new low in TVL.

What does this mean? That it’s significantly more difficult being profitable in the short term. For one thing to take off, liquidity needs to flow out from another area in DeFi. Unless you have a solid edge in the space or spend 16h+/day in front of the screen, the best thing to do is likely to develop a long term thesis and sticking to it. Don’t get shaken out by over-trading in this hostile environment.

Why did prices crash?

As seen from the image below on Coinalyze, a large part of futures open interest was wiped out August 17th which led to major liquidations of long positions. Crypto volatility has been incredibly low for a several weeks and when that happens open interest builds up as futures traders place their bets on which direction the market is going to move when volatility returns. When the price started crashing, large amount of longs got liquidated which caused more positions to get liquidated and so on. It’s therefore difficult to attribute the recent price action to any specific news. There has further been large selling in the spot market which could indicate that a larger player is offloading their positions.

The winner of the past 14 days🔵

Looking at crypto Twitter (crypto X??) alone, you wouldn’t notice the decline in prices and the boring market. Base, the new rollup chain by Coinbase, has seen a vast inflow of users and liquidity recently primarily because of the friend tech app.

Some stats comparing Base/Arbitrum/Optimism📊

14d Fees

$3.4m - Base

$2.6m - Arbitrum 👇

$2.5m - Optimism Revenue

14d Revenue

$2.3m - Base

$0.9m - Arbitrum

$0.8m - Optimism

Revenue is calculated as the fees paid by users on the rollup minus the cost of posting these transactions (call data) on Ethereum. As seen, not only has Base generated more fees recently, it appears the profit margin is also significantly higher.

friend tech

Friend tech is the new social app on Base where you can buy and sell shares of Twitter profiles that are signed up on the platform. It has exploded in adoption and has generated over $3m in revenue the past 7 days. All transactions come with a hefty 10% fee where 5% goes to the platform and 5% to the user whose shares are being traded.

friend tech is the main dapp attracting users to Base. As more protocols launch (like Aave and Uniswap) and the ecosystem expands, Base could continue growing in real terms. Current 7d revenue annualized is ~$42m which is a significant part of Coinbase’s annual revenue. Maybe it’s worth paying attention to $COIN?

News and Catalysts 📰

1️⃣ ETF Deadlines and Grayscale Case

Grayscale has an ongoing lawsuit with the SEC about converting its current GBTC trust into a spot BTC ETF. While many has been expecting a decision this week, Grayscale can be asked to re-apply taking up to 240 days before a final decision. As seen below however, Grayscale is expanding their ETF team. What does this mean?Most likely that they are trying to convey a message of being serious about converting to an ETF rather than them having some sort of insider knowledge regarding the outcome of the case.

Additional ETF headlines worth monitoring👇

A lot of deadlines in early September. It appears from ETF experts that a delay is most likely.

2️⃣ Coinbase Acquires Stake in Circle

Coinbase has added another potential cash-cow to their roster with the recent Circle equity acquisition. While the terms of acquisition are unknown at this point, it’s been revealed that the ‘Centre Consortium‘ group which governed USDC will be shut down. USDC will further be launching on 6 additional chains throughout the year. Some of these are expected to be Polkadot, Near, Optimism and Cosmos. In terms of revenue sharing, Coinbase and Circle will still share revenue based on the amount of USDC held on each of their respective platforms while interest income earned on the broader use of USDC will be split equally. Read more here.

3️⃣ Frax Expands Into RWAs (Real World Assets)

Following the depeg of USDC earlier this year (which $FRAX is heavily collateralized with), the vision of FraxV3 has been in the works. FRAXV3 is called ‘the final stablecoin‘ by founder Sam Kazemian. This involves a partnership with the Financial Reserves and Asset Exploration Inc Public Benefit Corporation (FinresPBC) to bring real world assets on-chain as collateral for $FRAX. The profits from these operations will pass on to token holders via so-called ‘Fraxbonds‘ (FXB). Fraxbonds allow people to buy $FRAX in the future at a discount (i.e buy FRAX two years from now at $0.9 per $FRAX). More on this in the article by Flywheel here.

4️⃣ Thorchain Lending Goes Live

Thorchain has just shipped their lending product and users can currently borrow a large variety of assets against BTC and ETH. The collateral list will soon expand with several new assets such as BNB, BCH, LTC, ATOM, AVAX, DOGE.

Some of the core mechanism of this lending design involves burning of $RUNE when debt is issued (user borrows against collateral) and $RUNE is minted when positions are closed. This also enables loans without liquidations even when collateral such as ETH or BTC decreases in price as collateral is stored as RUNE behind the scenes. Due to these unique mechanics, I suggest reading the article here for a more comprehensive understanding of the product before deciding to use the lending market.

On-chain Movements 🐳

Off-chain Labs appear to be buying back $ARB

1.72m ARB was bought on Binance at $0.98 per token (~$1.7m in total) and was sent to an adress labeled as Offchain labs (the company behind Arbitrum). This is close to the lowest ARB has been trading at since going live earlier this year. Address

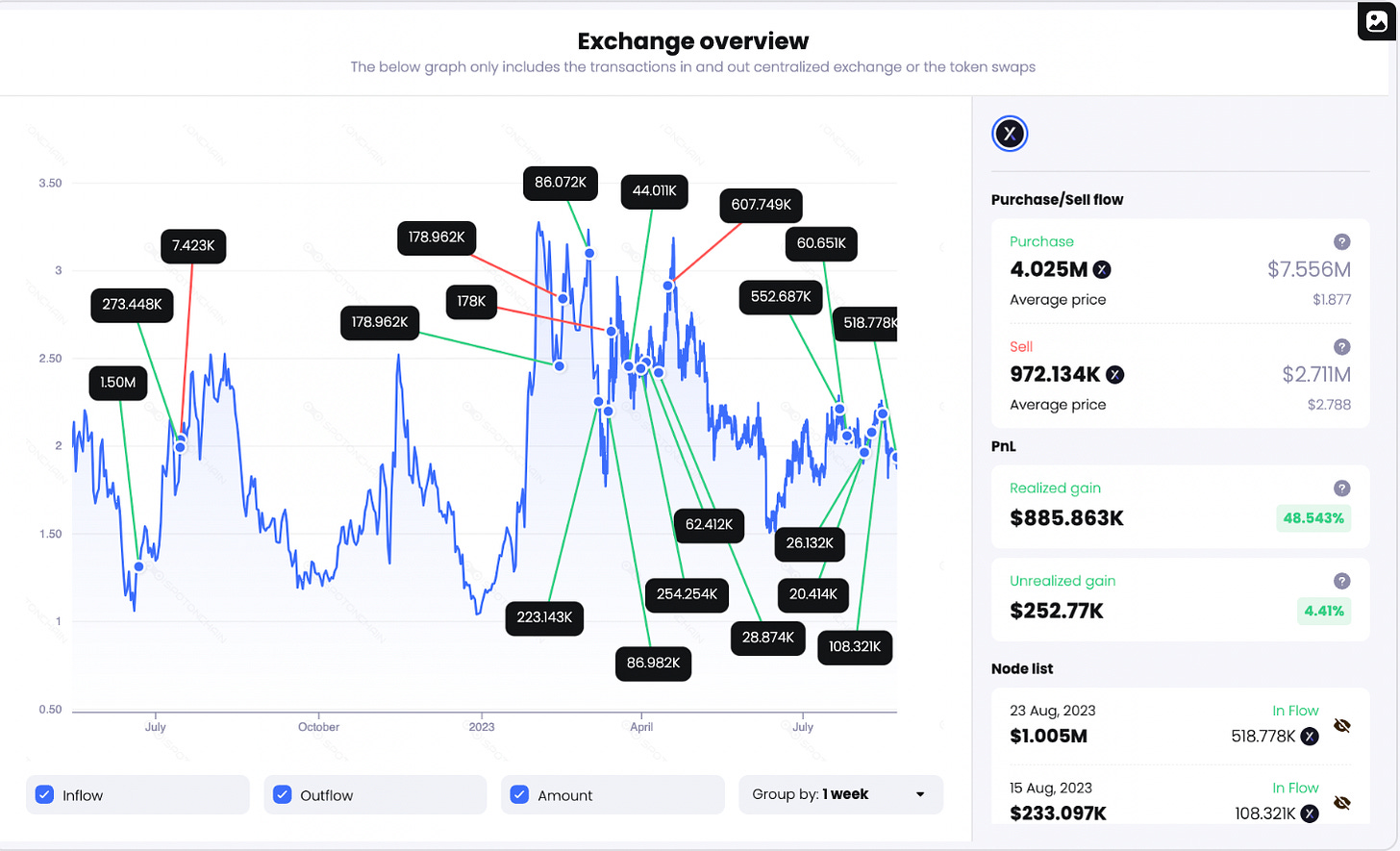

CMS Holdings accumulates $DYDX

CMS is an early investor in dYdX and has further traded the token over the past two years. They recently bought 519k $DYDX on Binance at $1.94 ($1m). The average purchase price from CEX trading (excluding private sale) has been $1.88 and average sell price $2.78. Today, CMS holds 3.05M $DYDX ($5.98M). Address

Amber Group buys $10m+ worth of $OP

Wallets tied with Amber Group have bought 8.14m OP at $1.53 ($12.7m) on average from centralized exchanges over the past few weeks. Amber Group also acquired 300k $DYDX at $1.93 ($580k). Address 1. Address 2

Source for all on-chain information: SpotOnChain

DeFi Airdrops & Strategies 🔮

friend tech airdrop

friend tech will be rewarding 100m points over the next 6 months to users of the platform. Below is a table estimating the price of each point depending of the launch valuation and the percentage of the token supply airdropped.

It seems that points are rewarded based off trading volume of ones shares but perhaps also referrals. Nonetheless, it seems the top profiles have amassed most of the distributed points so far.

Real world asset (RWA) farming

Maker’s Spark Protocol offers 5% APY on the Dai Savings Rate (DSR). The yield comes from the revenue generated by the DAI collateral that’s in RWA’s like US-treasury bills. If you’re an American citizen who have direct access to US t-bills, this might not sound very exciting however a current proposal on Aave suggest that the liquid representation of the DAI savings rate (sDAI) should be added as collateral on the lending market. As seen below, looping this 8 times (depositing sDAI on Aave, borrow the native $GHO stablecoin, convert it to sDAI and repeating) leads to an APY of 11.29%!

This will probably not be live for the next few weeks and the APY doesn’t account for gas fees. Nonetheless, exposure in nothing but DAI, earning 11% APY on sustainable yield coming from the US gov is pretty exciting and could onboard new and more sophisticated actors to the space on a longer time frame.

Swell Airdrop

Swell is an Ethereum liquid staking protocol with an ongoing airdrop campaign. Staking ETH as swETH earns you ‘pearls‘ over time which will translate to the $SWELL token coming later this year. Depositing your swETH on protocols like Pendle or Maverick earns you additional pearls on top of this. Recent calculations estimate that 1 pearl ~$0.33.

Thanks for reading! If you found the newsletter valuable don’t forget to subscribe to receive the newsletter in your inbox every 2nd week. Also, I really appreciate any feedback in the comments below - Have a fantastic Wednesday☀️

Nothing stated is financial advice!

Great writing man. Keep it up!

Excellent summary. Thanks.