The [8] Largest Cash Cows in Crypto

A fundamental analysis of the top revenue generating protocols in crypto

Introduction

Thousands of projects come and go in the brutally fast-paced industry of crypto. Those that stand the test of time are the few enviable projects that have tapped into some form of product-market-fit. Which protocols are users actually paying money to use? This article breaks down the top revenue-generating business models of crypto since 2024.

[8] Base

Launched in Q3 2023 by Coinbase, Base is an Ethereum L2 chain built off the Optimism Stack. In less than a year after going live, Base has generated an impressive $52M in revenues YTD, making it the 8th highest protocol. Revenue is generated by users paying fees to transact on the rollup.

On the earnings side, Base’s profits are fairly impressive with ~$35M YTD. There are two key factors at play here. Firstly, Base has significantly reduced data availability costs thanks to the use of blob fees in EIP-4844, implemented on 13 March. Base took advantage of blob fees immediately and data availability costs were cut from $9.34M in Q1 2024 to $699K in Q2 2024, a significant reduction of ~13x. Secondly, Base’s high earnings relative to its L2 competitors is also due to zero costs in token incentives paid out as it does not have its own native token.

[7] Lido

Lido’s business model is fundamentally interlinked with Ethereum. Historically, the onus for Lido was due to staked ETH on the Beacon Chain being locked. With its stETH derivative, Lido allowed ETH stakers to simultaneously earn network rewards (i.e., ETH issuance, priority fees and MEV rewards) by staking ETH and unlock the illiquidity of their staked capital. All that changed until the Shapella hard fork upgrade in April 2023 which allowed for Beacon chain withdrawals.

Today, Lido remains popular because it makes it accessible for ETH holders to partake in network validation and receive a share of network rewards. Another advantage that Lido stakers enjoy is an auto compounding efficiency, unlike solo stakers who are limited by the need to stake in 32 ETH blocks.

Lido in effect functions as a double-sided market bridging the average ETH holder and professional node operators. User-staked ETH is directed to a diverse group of node operators that the Lido DAO approves. As of today, there are a total of 109 node operators, a large majority of which were onboarded in its April implementation of the Simple DVT (Distributed Validator Technology) Module.

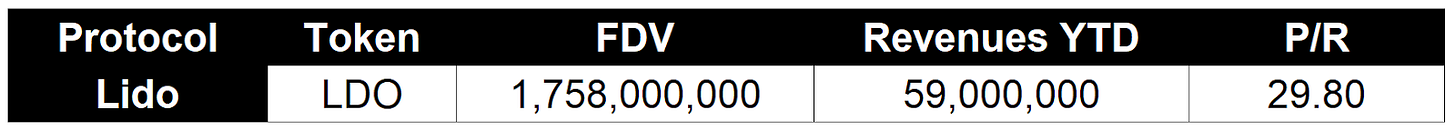

The liquid staking giant comes in at 7th highest revenue generating protocol. Lido has generated $59M in revenue YTD across the two chains it operates in: Ethereum L1 and Polygon PoS. Lido’s revenue flow comes from a 10% fee on user’s staking rewards, which is subsequently split 50:50 between node operators and the Lido DAO treasury.

Total profitability to Lido DAO YTD comes up to $22.5M after reducing the 5% of staking rewards paid to node operators, and LDO incentives paid out to CEX/DEX liquidity pools.

[6] Aerodrome

Enter Aerodrome, an AMM DEX on Base L2 by the same founders behind the Velodrome DEX on Optimism. Launched in August 2023, Aerodrome has quickly established itself as the top DEX on Base with a TVL of $470M. According to TokenTerminal, Aerodrome has generated $85M in revenue YTD, while paying out $29.7M in token incentives in the last 30 days.

Aerodrome’s secret to success? Its frantic copying and combination of many successful mechanisms across the DEX landscape.

To attract deep liquidity, Aerodrome relies on veCRV (vote-escrowed CRV) bribe tokenomics with its AERO token. AERO tokenholders can lock up AERO for up to four years, gaining voting power to direct future emissions to LPs based on the number of veAERO votes received each weekly epoch. On Aerodrome, 100% of pool trading fees are received by AERO lockers unlike a 50:50 split on Curve to LPs and CRV lockers. Another interesting twist is that unlike Curve, rewards are proportionate to the pool’s trading volume performance, thereby encouraging veAERO voters to direct emissions toward the most productive trading pools. Both of these core protocol design mechanisms are the key incentives behind Aerodrome’s deep liquidity pools.

To simplify its vote-escrow system, Aerodrome took another page out of Curve’s book and implemented its own version of “Votium” called “Relay”, a system where locked AERO tokens are automatically pool-vote and compounds yield to be swapped back into VELO.

Another piece to Aerodrome’s success is also “Slipstream”, a fork of Uniswap V3’s concentrated liquidity contracts. This has undoubtedly helped Aerodrome compete against Uniswap on particularly high volume trading pairs such as WETH/USDC.

[5] Ethena

Arguably the most successful protocol of 2024 is Ethena. Backed by major investors Dragonfly and Arthur Hayes, Ethena sprang on the scene as a new entrant in the stablecoin market. Since its launch in January 2024, USDe growth has achieved an impressive 3.6B marketcap, making it the fourth largest stablecoin asset today. Its USDe token however, is not technically a USD-pegged stablecoin, but more accurately a synthetic dollar.

How does Ethena work? Like Maker’s DAI, Ethena’s USDe is a USD-pegged stable asset backed primarily by ETH and stETH deposits. Where it differs however is in how USDe yield is generated. USDe yield comes from a delta hedging strategy that exploits the difference in funding rates across CEX and DEX perpetual futures markets. When funding rates are positive on CEXs, Ethena earns the funding fees via a short position on that exchange. At the same time, Ethena pays funding fees via a long position on a DEX where the funding rate is negative. These simultaneous positions allow USDe to retain its peg no matter the directional headwinds of ETH.

Ethena currently does not take any protocol fees. Its main revenues at present are derived from staking the ETH that users deposit to them to earn network issuance and MEV capture. According to TokenTerminal, Ethena is the fifth largest revenue generating business today making $93M in annualized revenues. After accounting for costs paid out in sUSDe yield, Ethena is making $41M in earnings, making it the most profitable dapp YTD.

It’s worth noting however that Ethena’s business is designed to excel in a bull market, which cannot last forever. Ethena’s successful points campaigns is also unsustainable. With each wave of ENA unlocks, interest and confidence in Ethena is continually diluted. To counteract, Ethena has tried to introduce utility into ENA via two ways: locking up ENA for the highest boosted points in Season 2, and more recently tapping into restaking yield with its vaults on Symbiotic. For more, see our previous articles on ENA locking and ENA restaking.

[4] Solana

For a chain that was all but pronounced dead just less than a year ago, Solana is doing pretty well. The Solana comeback was caused by a myriad of factors: memecoin trading, its “state compression” update that helped attract DePIN founders and a resurgence in NFT trading, the acclaimed JTO airdrop in December 2023 that sparked huge capital inflows into Solana.

Solana today ranks fourth in revenue-generation at $135M in annualized revenues YTD. This is derived as the share of transaction fees that users pay to validators for using the network. If we account for token issuance (costs) however, Solana is seemingly unprofitable, having paid out $311M in token incentives for just the last 30 days.

This takes us to the thorny subject of L1 business valuation. Solana proponents would likely argue that assessing L1 blockchain profitability on the above “revenue - cost = profit” basis is irrelevant. This critique takes the view that network issuance is not a cost, since L1 tokenholders on a PoS chain can access these value flows by staking with a popular liquid staking platform such as Jito on Solana or Lido on Ethereum. For more on the nuances of L1 blockchain profitability, see our previous article here:

[3] Maker

Launched in late 2019, Maker’s business model is simple to understand – issue the DAI stablecoin against crypto collateral that the protocol charges an interest rate on. Yet, under the hood, Maker’s inner working operations are fairly complex.

Maker has undergone lots of changes since its original inception. To induce DAI demand, Maker has incurred costs through the “DAI savings rate” (DSR), a staking yield for locking up DAI. To survive the bear market, Maker spun up a core unit focused on buying real-world assets like US T-bills. And to scale, Maker has sacrificed decentralization by relying on USDC stablecoin deposits via the peg-stability module since 2022.

Today, total DAI supply is 5.2B, off 55% from its historical all-time-highs of ~10B in the 2021 bull market. The protocol has generated $176M YTD. Based on Makerburn, the protocol makes $289M in annualized revenues. A significant portion of revenues (14.5%) in recent months is thanks to the DAO’s somewhat controversial decision in April to enable DAI loans against Ethena’s USDe collateral in a Morpho vault. RWA revenues are also fairly significant at $74M annualized, making up 25.6% of total revenues.

How much does Maker make in profits? As mentioned above, one of the ways Maker tries to incentivize DAI demand is through the DSR, a yield paid out to users who stake their DAI. Not every DAI holder takes advantage of the DSR since it is also used throughout DeFi for various purposes. Assuming a 8% DSR at a stake-rate of 40%, that costs Maker ~$166M. Therefore Maker’s earnings can be estimated at roughly $73M annualized after accounting for another $50M in fixed operating costs. For more, see Onchain Times’ previous Maker valuation:

[2] Tron

The second biggest revenue generator in Web3 is the L1 Tron network, raking in ~$852M in revenues YTD according to TokenTerminal.

Tron’s success largely stems from huge stablecoin activity on its network. In an Artemis interview with Head of Ecosystem Development at Tron DAO David Uhryniak, the majority of these stablecoin flows are from users in developing economies like Argentina, Turkey and various African countries. Based on the below chart, we can see that Tron typically ties with Ethereum and Solana for highest transfer volumes of stablecoins.

Tron’s dominant use-case as a stablecoin network is also seen in its stablecoin supply at 50-60B, second only to Ethereum.

[1] Ethereum

Finally we come to the highest revenue generating business in Web3 today: Ethereum. On a YTD basis, Ethereum makes about $1.42B in revenues.

How profitable is Ethereum though? When we add up the amount of transaction fees users pay for using Ethereum mainnet minus inflationary rewards paid to PoS validators, we can see below that the network was profitable in Q1 but unprofitable in Q2. Q2 unprofitability is likely due to most transaction activity moving off to Ethereum rollups to take advantage of lower gas costs.

Like other L1s however, the “revenue - minus = profit” framework to assess blockchain profitability obfuscates the real value flow to ETH stakers since users can receive a share of network issuance by staking with a liquid staking platform. For a more comprehensive breakdown of these value flows, see On Chain Times’ previous article.

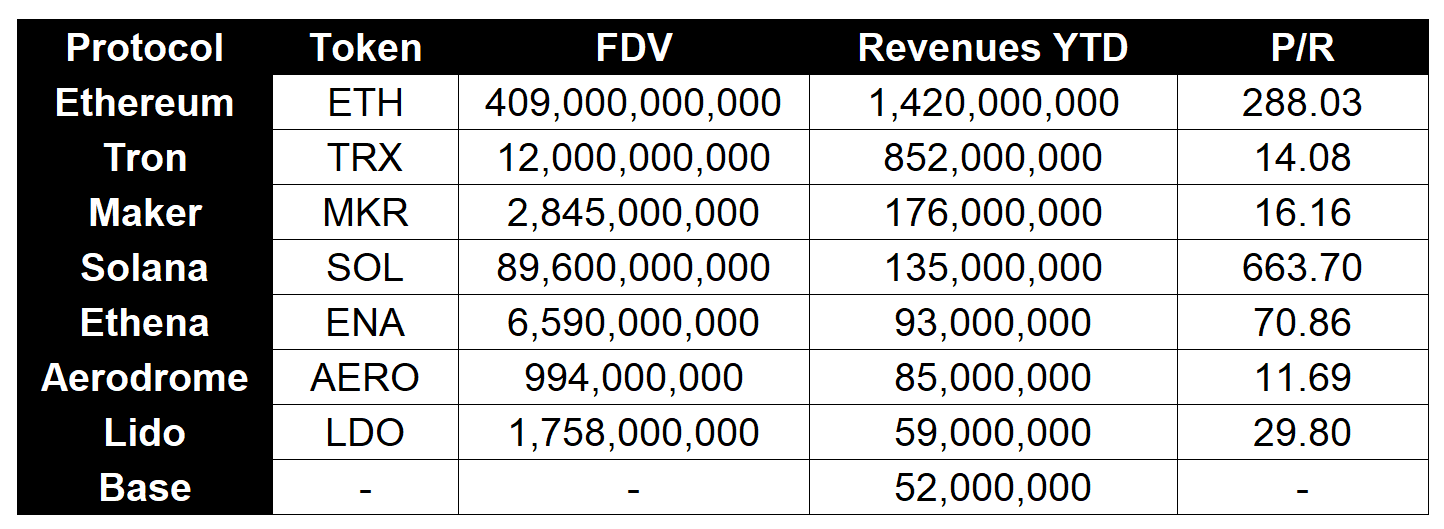

The top eight cash-cows of Crypto YTD

Summarizing all of the above we obtain the following table:

Honorable mention - Aave

In the lending DeFi sector, Aave is unsurprisingly the top by revenue generation at $31M YTD. For the last three years, Aave has enjoyed a comfortable market leader position in lending, with 62% of market share today by active loans.

Aave’s last major launch was V3 in March 2022, introducing features like cross-chain swaps and isolated lending markets. The protocol recently announced in May an upcoming V4 launch, scheduled to be released in 2025. V4’s key upgrade is a unified liquidity layer powered by Chainlink’s CCIP aggregating liquidity across different chains. Other improvements include an Aave-specific chain, automated interest rate curves, smart accounts and an updated liquidation engine.

Disclaimer: The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.

Interesting.

Nice post