🀄️Here's Where DeFi Innovation Is Happening - DeFi Frameworks Newsletter #002

Your biweekly newsletter on the latest performance, news, catalysts and more

Welcome to the second DeFi Framworks Newsletter! Today’s topics will be on the growing sectors of DeFi, recent innovation, on-chain movements and more!

Bullets

DeFi Sectors 🗺

News and Catalysts 📰

On-chain Movements 🐳

DeFi Strategy Spotlight 🔮

DeFi Sectors 🗺

The total value locked in DeFi remains relatively flat since the previous newsletter 14 days ago (up ~200m). What does it take for this to change? Bullish BTC price action? New dapps? More scalable chains? Let me know in the comments at the end of the newsletter.

Liquid Staking Derivatives (LSDs)💧

Liquid staking continues to grow in ETH terms and is up nearly 224k ETH ($420m) in the past two weeks📈

Below is an overview of the largest liquid staking providers and their recent growth.

Stader launched their liquid staking solution for ETH a few days ago and are incentivizing users with additional yield from the native $SD token. It’s therefore likely that they’ll continue to see a liquidity-inflow the next few weeks as long as they are paying to onboard new users. Swell (swETH) has also grown recently as users are farming their upcoming token airdrop. Besides a growth for the smaller protocols, the overall market share has stayed relatively flat with Lido still accounting for more than 3/4 of all liquidity.

A view on recent price performance for the native tokens of these protocols:

Price/Staked ETH is calculated by dividing the FDV with $-value ETH staked and the lower the better the valuation. From this metric alone, $LDO still trades at the best value. Keep in mind that a protocol like Frax also generates revenue from its other products and not just from their liquid staking solution.

Dex-Perps📊

On-chain trading protocols (dex-perps) continue to show strong product market fit as trading volume increases and new innovative designs prepare for launch. Below is a table of the 8 largest dex-perps, their recent trading volume and fees generated.

The ‘Total’ tab displays the sum of all dex-perps, not just the ones shown in the table.

Notably, Kwenta is catching up to the larger protocols as it is the 3rd largest dex-perp in terms of 30d volume and not far behind GMX. Not long ago, GMX and dYdX accounted for nearly all on-chain trading volume. As the space matures and more protocols with unique features appear, it makes sense that many of these are able to catch different parts of the market.

On the other hand, be aware of ‘clones’ who essentially just fork an existing product. These might do well in the short term if they incentivize trading with native token emissions, but as soon as this incentive decreases, users leave due to the lacking edge of the protocol.

News & Catalysts 🗞

1️⃣ Yearn Finance gets ready for their LSD launch

Yearn Finance is an OG yield aggregator in the DeFi space, built by Andre Cronje. Earlier this year, the team revealed their plans to launch a new liquid staking solution for ETH by the name of yETH, with the launch only being a few weeks away.

yETH consists of a basket of LSDs, 'designed to give you the best risk-adjusted ETH staking yield in a single token.' The exact composition of yETH is decided by the community via governance.

An explanation of the roadmap above:

Whitelisting: Protocols looking to create more demand for their product apply to have their LSD be apart of the basket making up yETH.

Deposit & Incentives: Users can deposit their ETH and receive the st-yETH token.

Vote: In this period st-yETH holders vote on which LSDs should make it into the yETH. They are incentivized to do so as protocols applying are bribing users with token emissions.

Launch: 5 most voted protocols have their LSDs added to yETH and users can start to earn yield on the token.

Every epoch, protocols compete to be part of the basket making up yETH.

2️⃣ Frax Finance $FXS buyback program gets approved

There is a lot of interesting things happening over at Frax Finance currently. Latest innovations include the upcoming frxETH 2.0, Fraxchain, and the recently announced $FXS buyback program. A proposal by Ouroboros Capital suggests a variety of changes to the old buyback program. In its essence, this introduces a gradual purchase of $FXS worth $1m when the price is below $5 and an additional $1m if below $4. The purpose is for Frax to increase its protocol-owned liquidity and buy when the price is deemed 'undervalued.' The proposal has been approved and will make it more difficult for FXS to go below $4-$5 (but not impossible, of course).

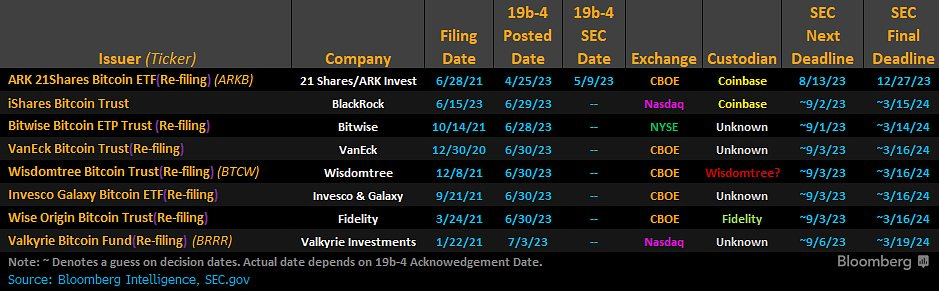

3️⃣ Bitcoin ETF dates to watch

Below are the important dates for all of the BTC ETFs that have been filed. The Ark ETF has the next deadline on the 13th of August. The following ETFs have their first deadline in early September and can all be pushed till Q1 2024.

This was quote-tweeted by Hal Press from North Rock Digital in which he states; “When I look at these dates I could see a scenario where ARKK gets pushed on August 13th and approval doesn't come until early September”.

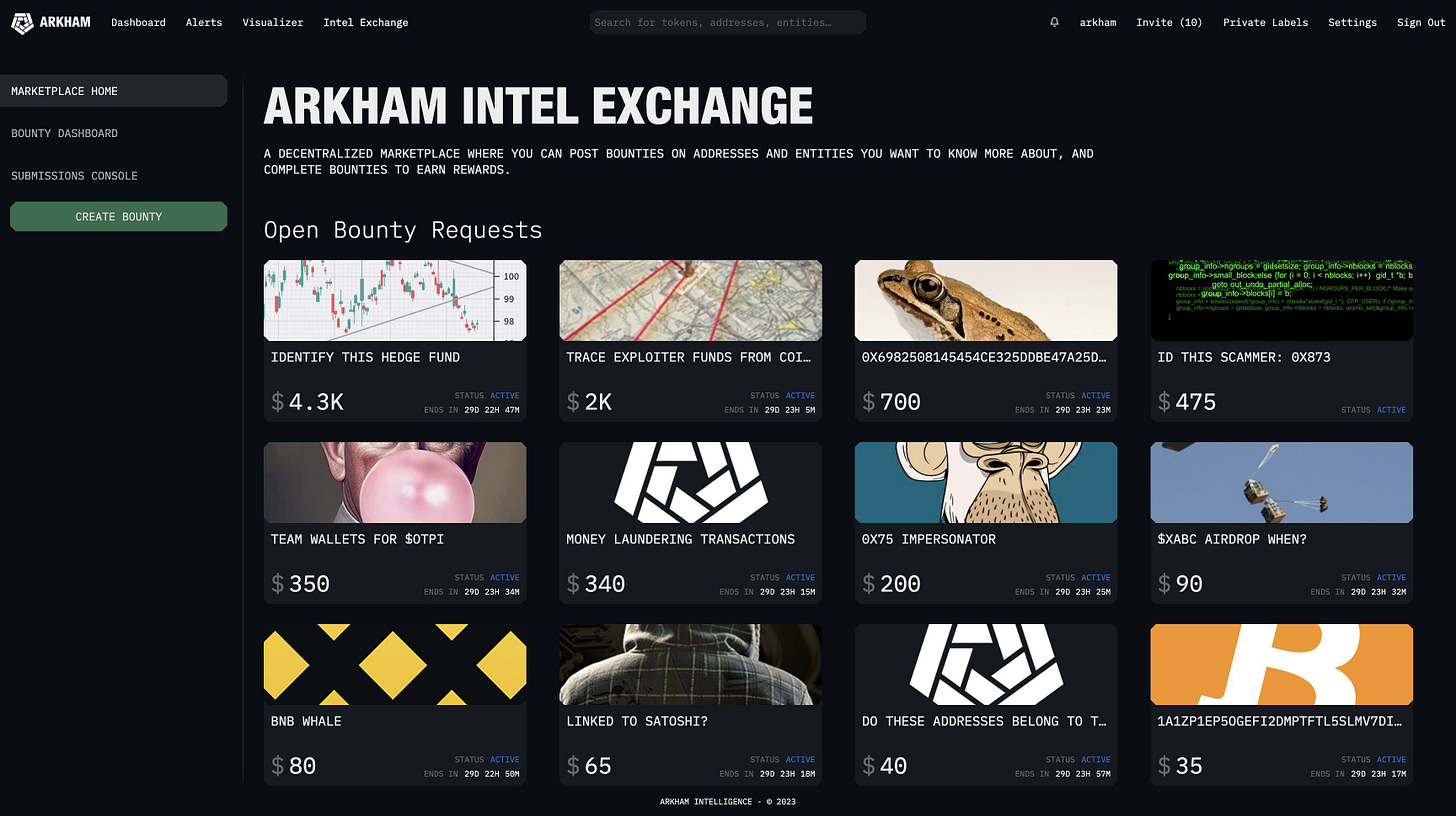

4️⃣ Arkham Intel announces AKRM token and intel exchange

Arkham Intel is an on-chain analytics tool that allows users to track entities, flows, and tokens on-chain. They recently announced their Intel Exchange, where funds, researchers, and investors who are all looking for information about on-chain activities can create jobs/bounties. Arkham has received quite a lot of backlash from this, so it will be interesting to see whether this product works as intended and if they are able to distinguish between real and fake information.

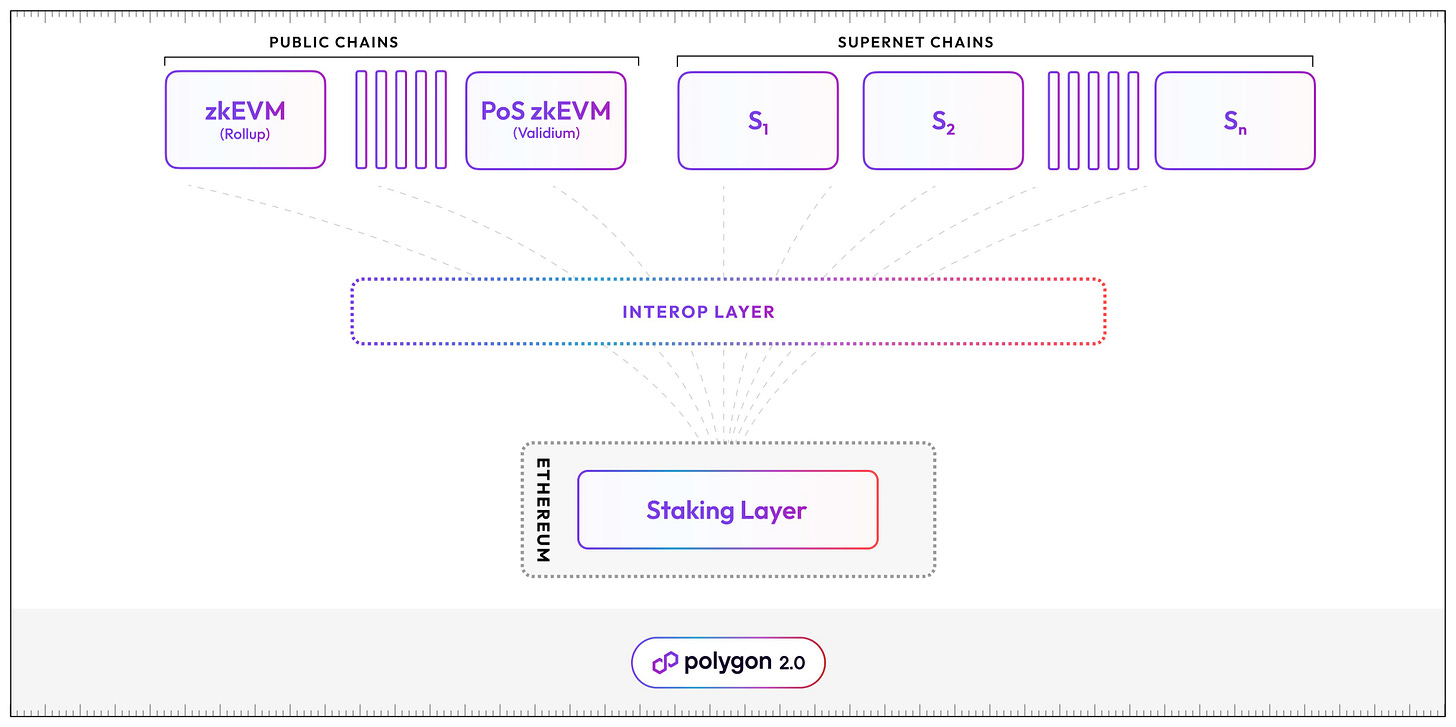

5️⃣ Polygon 2.0

Polygon 2.0 was recently announced as it all about connecting current infrastructure products built by the network. Here’s a brief overview:

Staking layer: Validators stake MATIC in a similar fashion as the PoS chain today.

Interop layer: Shared bridge that allows chains to mint assets to and from Ethereum in an interoperable way.

Execution layer: Polygon 2.0 will operate with two different sets of execution layers.

Supernets: Application specific blockchains similar to Avalanche’s subnets or the app-chains on Cosmos.

Public chains: The zkEVM will use Ethereum for data availability and will be the most secure but also the most expensive rollup. The proof of stake zkEVM uses Polygon for data availability (secured by MATIC) and simply just post the proofs on Ethereum for more scalability.

6️⃣ Pendle launches on the BNB-Chain

Pendle has recently expanded to its third chain recently with two pools live as of now:

wBETH (Binance staked ETH)

frxETH-ETH from Thena Fi

The liquidity pools on Pendle are used for yield-trading on the protocol and are without impermanent loss if held till maturity. There is no lock-up of liquidity in any of the pools on Pendle. The team is working on a variety of upgrades behind the scenes to improve the user experience and attract new liquidity.

7️⃣ dYdX V4 testnet goes live

dYdX is launching on its own native Cosmos app-chain later this year which seemingly is getting closer with the public testnet going live recently:

https://v4.testnet.dydx.exchange/

Despite being in the Cosmos ecosystem, users can connect simply with their preferred browser wallet like Metamask without having to download a Cosmos native wallet (such as Keplr). While this might seem like a small detail, it’s quite significant from a user perspective and something that’s important when trying to attract less DeFi-savvy users.

On-chain Movements 🐳

Hashkey accumulates $PENDLE

Hashkey is one of the early investors in Pendle and has been making a large profit buy buying low and selling high. The fund seemingly sold $2.8m worth of $PENDLE on the day of the Binance listing at a price of $1.15. On July 6th they re-purchased $900k worth of $PENDLE at $0.85. They total trading profits from PENDLE is estimated to be roughly $3m. Wallet

Amber buys the $BLUR dip

Amber Group holds a total of 22m $BLUR ($7m). On June 28th, Amber acquired 2m $BLUR at $0.36 per $BLUR. Their average cost basis is $0.497 which leaves the ROI at roughly –28%. Other notable investments include $16m $LDO, $18m $DYDX, $7m $AAVE and $12m $ETH.

Trader Makes $4.5m profit from $ETH trading

A smart money entity holding $31m worth of crypto has made $4.5m (ROI 46%) from trading $ETH since November 2022. The investor bought ETH after the FTX dump last year and at the dump in June 2023 (cost basis $1218). The whale has taken profits in February and again a few days ago (average price $1779). The wallet still holds $22m $ETH with an unrealized gain of $9m. Wallet

Other notable

a16z deposited 6.4k MKR ($6.15m) worth of $MKR to Coinbase yesterday (likely selling). They received 60k MKR back in 2018 through a private sale.

Justin Sun deposited $43m worth of ETH on Poloniex June 8th. Justin still holds over $430m in his on-chain wallet: Wallet

Source for all on-chain movements.

DeFi Strategy Spotlight 🔮

1️⃣ 35% APR on staked ETH

Swell Network is an ETH liquid staking provider who currently runs a so-called ‘Voyage‘ campaign in which early stakers farm their upcoming $SWELL token. It’s according to the protocol, estimated to be equal to ~35% APR if $SWELL is sold at the launch price.

Source of yield: Upcoming $SWELL airdrop and staking yield (2.5%)

Risks: Smart contract risks on Swell.

2️⃣ 8-10% APY on ETH with Pendle Finance

Users on Pendle can deposit into the liquidity pools on Pendle to earn a high yield with no lock-up and nearly zero impermanent loss. The liquidity is used by yield traders on the protocol. The image below is from the Arbitrum pools and the higher APY displayed is obtained if users lock up the native $PENDLE token. The yields on the BNB-chain are slightly higher on similar pools currently but will likely decrease as more liquidity is deposited.

Source of yield: $PENDLE emissions and trading fees from yield traders

Risks: Smart contract risk and exposure to the wstETH token from Lido Finance

A higher beta strategy (higher risk/higher reward) is depositing into the very same pools on Penpie. Penpie controls a large part of the $PENDLE supply and offers boosted yields on the Pendle pools without users having to lock up $PENDLE themselves.

Why did I mention increased risk? Because you are taking on additional smart contract risks.

3️⃣ Fixed yields on stablecoins

If you are concerned about fluctuations in the yield, you can buy the principal token on Pendle Finance which allows you to receive a fixed yield until maturity. As seen below you can currently lock in 3.29% APY on the USDT pool from Stargate for 351 days and 8.31% on the gDAI pool from Gains Network for 260 days.

Source of yield: The yield comes from the underlying yield of the assets (gDAI and USDT pool on Stargate) and are also dependant on trading activity on Pendle.

Risks:

USDT: Pendle and Stargate smart contract risk.

gDAI: Pendle and Gains smart contract risk. You are also the counterparty to traders on Gains Network when holding the gDAI token.

Disclaimer: Pendle and Penpie are partners of the brand.

That’s all I had for today! If you found the newsletter valuable don’t forget to subscribe to receive the newsletter in your inbox every 2nd week - Have a fantastic Wednesday☀️

Be aware that nothing stated is financial advice!

I like your newsletter.

Question on the fixed yields on stablecoins. Using the gDAI example, the fixed APY is 8.3%. Setting aside the risk of being counterparty to traders on Gains Network. If I purchase the principal token and hold it for 6 months, can I sell that token and lock in 4.15%?

Great newsletter!