🀄️DeFi Frameworks Newsletter #001

Your biweekly newsletter on the latest performance, news, catalysts and more

Welcome to the 1st ever DeFi Frameworks newsletter! I’ve spent the past weeks studying other publications to analyze what’s missing in your inbox.

Bullets

DeFi Sectors 🗺

News and Catalysts 📰

On-chain Movements 🐳

Level Up Your Knowledge 🧠

DeFi Sectors 🗺

As overall TVL in DeFi remains flat, who are the winners attracting liquidity from elsewhere in the space?

Liquid Staking Derivatives (LSD’s)

Liquid staking is the largest growing sector in DeFi and one of the usecases with the best product market fit. As seen below, the Ethereum liquid staking market has grown from $7b to over $18b this year alone. Pretty impressive given there’s been 0 inflow of new money into DeFi in this period.

The two tables below are filled with information about recent growth, movements and valuations for liquid staking providers.

The data above shows large inflows of staked ETH into Lido, Rocket Pool and Swell. Frax Ether continues to deliver the highest yield and the protocol has also experienced growth in TVL recently, however not as much as some competitors. Swell recently launched their staking service and are doing a campaign that lets stakers farm tokens for their upcoming airdrop. Time will tell whether Swell will be competitive once this campaign is over.

Altcoin prices have been in decline the past month and LSD native tokens are no exception as seen above. Price/staked ETH is a measure of how expensive the token is relative to the amount of ETH staked on the protocol. It is calculated by dividing the FDV with $-value ETH staked and the lower the better the valuation. Keep in mind that Frax finance has other products than just frxETH and that’s likely why it’s trading at a higher valuation.

New entrants to keep an eye on

Swell launched in late April and has seen a liquidity inflow of over $50m. Swell takes no commission on the staking yield and are working on ‘optimized staking vaults’ for a higher return. Swell has not launched their native token yet but it can be farmed by staking ETH on the protocol.

Stader Labs is launching their ETHx product in July. The main feature is the possibility to spin up a validator with just 4 ETH and 0.4 ETH worth of SD

The next newsletter will dig deeper into the fee models for each provider and their respective valuations based off this. Subscribe to not miss it⚡️

LSDfi

LSDfi protocols enable additional strategies on top of liquid staking tokens and is utilized by investors to earn increased yield. There are many protocols that offer yields on top of LSDs however below is a table of some of the most prominent.

The three top gainers in terms of liquidity (ETH) the past month have been Pendle, Lybra and Raft. Pendle offers a unique design on yield-trading and the native token $PENDLE has experienced a large rally and a new all time high just two days ago.

Both Lybra and Raft are protocols offering a stablecoin collateralized by liquid staked ETH. As of writing, these are just two out of 4-5 protocols having this exact same business model. It’s therefore safe to say that these will have tough competition moving forward especially if new similar protocols offer high incentives for liquidity.

Maverick, an AMM with ‘boosted liquidity pools‘ just published their token airdrop for liquidity providers. 125k adresses will share an $11m airdrop while the token is sitting at a $1b fully diluted valuation as of writing. Without being able to predict the future (lost my crystal ball the other day) I believe there’s a large probability that the in/outflow of LSD liquidity on Maverick will look substantially different in the next edition of the newsletter as users no longer can farm the airdrop.

Dex Perps

Dex derivatives, and perpetual futures trading in particular, continue to show strong growth. It is without doubt one of the sectors in DeFi with the most organic adoption and product market fit. As seen below, fees generated here has climbed significantly the past few weeks despite the market downturn and are close to the levels from earlier this year.

Some numbers you don’t want to miss👇

From above it is evident that dYdX continues to be the leader in terms of trading-volume both YTD but also the past month. Because of the higher fees however, GMX is the leader in recent fees. Of the seven largest protocols in this sector, all have positive earnings except for Level and Kwenta. This is due to their native token emissions outweighing revenue generated on the protocol (revenue as in the share of fees not paid to liquidity providers).

The table above displays recent token performance as well as some different models for evaluating these. Price/fees is calculated by dividing the fully diluted valuation with the YTD fees annualized. As with the LSDs, the lower the number the better. The cells containing ‘N/A‘ is because the earnings have been negative YTD.

Interestingly, Cap Finance has the best valuation both in terms of fees and revenue which is mainly due to their low FDV. A general sign of strength when analyzing these tokens is positive earnings. It sends the signal that demand is organic and the revenue-model is of proper quality.

As you know however many more variables need to be considered when deciding whether a token is a good investment such as upcoming catalysts, general sentiment around the project etc.

Token Terminal📊

All of the data used in this newsletter is pulled from Token Terminal. They offer a large variety of features including:

An overview of market sectors

In depth look at financial statements

Detailed protocol-specific data

Trending contracts

And much more! Check out Token Terminal and upgrade to a Pro account for full access to the platform which includes csv-downloads, a ton of additional metrics/charts, custom charts and much more.

News & Catalysts 🗞

1️⃣ BTC ETF season

Current tradfi institutions filing for a BTC ETF:

Bitwise

Invesco

Valkyrie

Grayscale

Blackrock

ARK Invest

WisdomTree

And now also Fidelity.

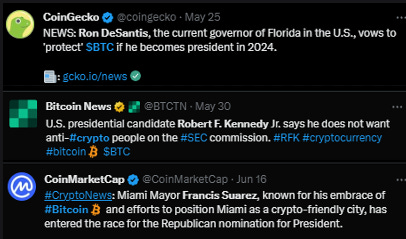

At the same time, the public opinion on crypto seems to have shifted recently:

- With J Powell also stating that crypto has staying power as an asset class. According to the post from @Evan_ss6 on Twitter, it seems we might get an answer already in August. Strap in ladies n’ gentlemen🫡

2️⃣ Rollup season

2021 was all about paying attention to the emerging alt-L1s. Today, this innovation has moved to layer-2 chains on top of Ethereum. Some upcoming launches to pay attention to:

Base - by Coinbase

Mantle - by BitDAO

Fraxchain - by Frax Finance

Especially the launch of Base could be significant due to the large retail userbase on Coinbase already. zk-EVMs like the Polygon zk-EVM and zkSync are also worth monitoring the next couple of months as more and more dapps deploy here.

Finally, dYdX is also launching their own chain with V4 (not as a rollup but as a separate chain on Cosmos). The upgrade will ship later this year and introduce a significant increase in decentralization including the way revenue is distributed.

3️⃣ EIP-4844

EIP-4844 aka Proto-Danksharding is likely coming to Ethereum later this year and introduces ‘data-blobs’ amongst other things to the ecosystem. This is estimated to make it far cheaper to transact on Ethereum rollups. Could this spark a significant narrative for L2 tokens like $ARB and $OP? And what the **** are datablobs?🤔 Read all about it in my in depth-article below👇

On-chain Movements 🐳

Arthurs Hayes buys $GMX

Arthur Hayes is the single largest $GMX investor and bought ~$100k worth of tokens June 12th at a price of $44.3. This increases his total holdings to 203k $GMX (~$11m) which was acquired over the past year at an average cost basis of $29 per token.

Blocktower Capital selling $ARB?

Blocktower capital acquired $2m $ARB between March and May this year at at price of $1.12. On June 13th, they moved 1.81M $ARB to Coinbase at $0.973 ($1.76M). If the asset was sold the fund occured a loss of $275.8K (ROI: -13.5%). According to Arkham Intelligence, Blocktower has $29m in on-chain holdings hereof $9m $MKR and $8.7m $NXM

Justin Sun making moves

On June 21st, Justin Sun requested to withdraw 15.8k $ETH (~$30m) from Lido which was staked. After being able to withdraw it June 23rd, Justin moved all of it to Huobi to potentially sell it. The $ETH was previously received from Poloniex last June at an average price of $1,199 ($18.67M). If sold that’s a profit of ~$11m (ROI: 59%).

Justin Sun further removed over $15m worth of stablecoins from liquidity pools on the BNB chain earlier in June and sent it to Binance and Huobi.

Other notable movements

ParaFi Capital sends all their 10k $MKR ($7.4m) to Coinbase. They invested in Maker back in 2020.

Hashkey acquired 18k $ETH at $1,670 ($30.47M) June 16th when the market was dipping. They have now moved 4.5k $ETH ($8.65m) to Binance June 22nd. If sold that’s a profit of $1.04M (ROI: 13.17%).

Check out my Wallet tracker for the full list of wallets.

Level up your knowledge 🧠

Some interesting articles/podcasts I’ve listened to/read lately.

1️⃣ Should Protocols Share Revenue With Token Holders? (Bell Curve)

An interest perspective on the role of tokens and whether it makes sense to distribute revenue.

2️⃣ Mike Novogratz on Crypto’s Outlook, Trading & Storytelling (1000x)

Mike Novogratz joins Avi Felman and Jonah Van Bourg to talk about the future outlook of crypto.

3️⃣ $100M Fight for Crypto in D.C with Ryan Selkis (Bankless)

Ryan Selkis from Messari talks about US crypto regulation.

4️⃣ Is Crypto a Scam? (by Ignas)

Great article on the flaws of the space. Allows you to view the industry from a different perspective for once (probably healthy?).

5️⃣ What would it take for crypto to have a new bull market? (by Tascha)

What we need to take the space to the next level is dapps that attract millions of users to the space. Read about it in the great thread below.

https://twitter.com/TaschaLabs/status/1667669027957911553

Thanks for tuning in! How could this newsletter be improved?🤔 I would very much appreciate your feedback in the comments below👇

Be aware that nothing stated is financial advice!

If you have any thoughts on what you would like to see in this newsletter please let me know!

The "Level up your knowledge 🧠" is an incredible idea. There are valuable content out there in the podcast and video field. Keep up the good work man!